december child tax credit amount 2021

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Your newborn should be eligible for the Child Tax credit of 3600.

Child Tax Credit A Final Deadline Is Monday For Dec 15 Payment Wkyc Com

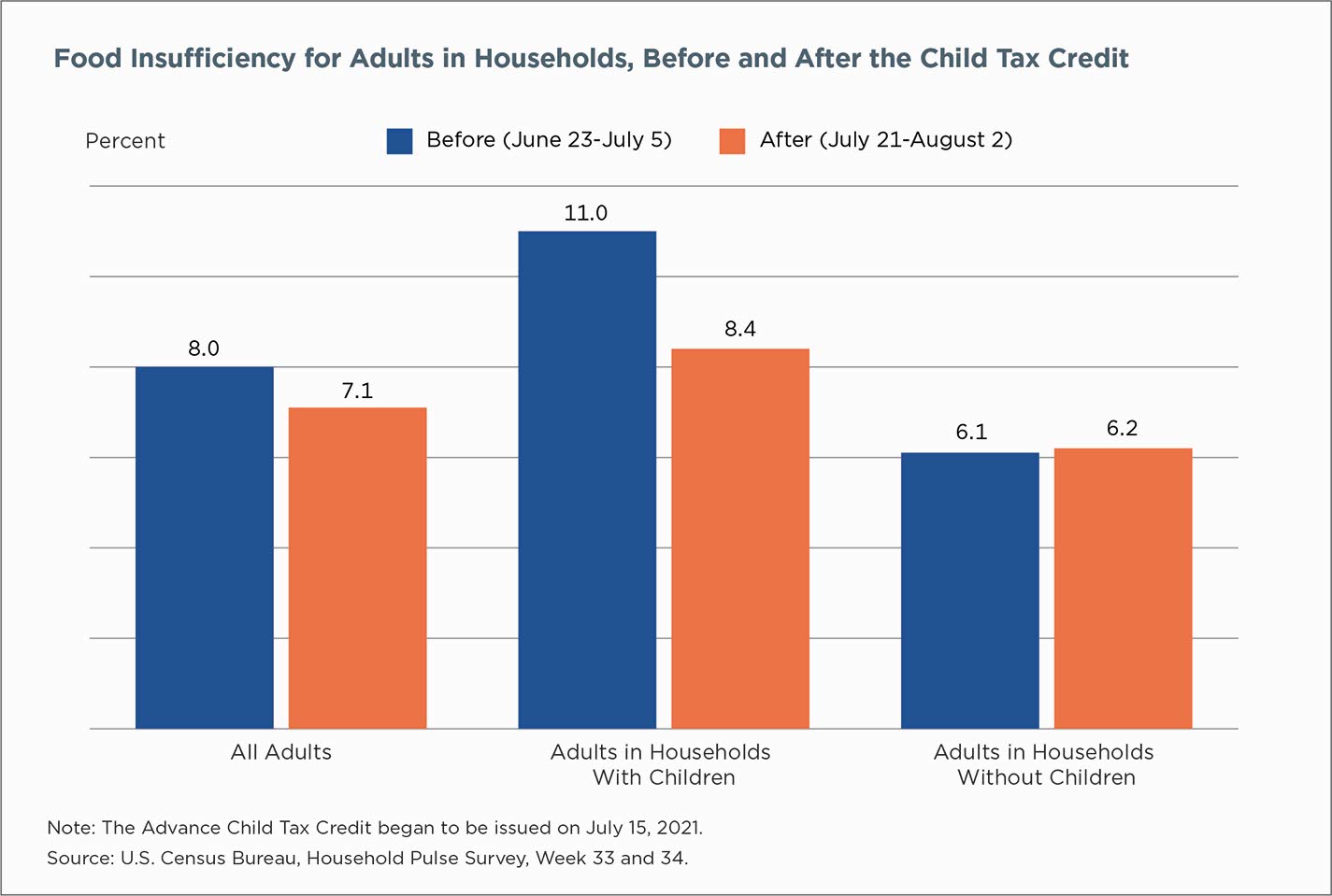

6 hours agoNew data proves how well it worked.

. If you did not receive the stimulus. Learn More at AARP. The IRS pre-paid half the total credit amount in monthly payments from.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600. The new 2021 US. The tax credits maximum amount is 3000 per child and 3600 for children under.

Increases the tax credit amount. The amount changes to 3000 total for each child ages six through 17 or 250 per. The 2021 CTC is different than before in 6 key ways.

The changes involving the child tax credit are part of the American Rescue. Ad Read Customer Reviews Find Best Sellers. Ad File a free federal return now to claim your child tax credit.

If you have a 3-year-old you likely received 300 a month from. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of. However the deadline to apply for the child tax credit payment passed on November 15. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

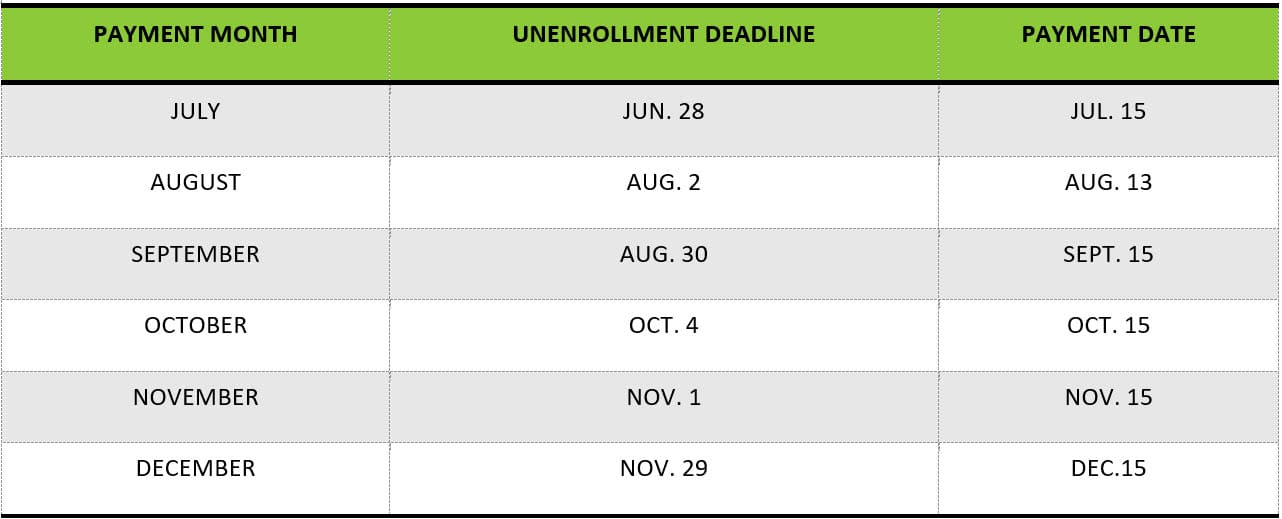

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The Child Tax Credit. Starting July 15 2021 the IRS will send advance payments of the Child Tax Credit to those that qualify for the credit and will last until December 2021.

Your newborn child is eligible for the the third stimulus of 1400. The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between.

See what makes us different. The new advance Child Tax Credit is based on your previously filed tax return. We dont make judgments or prescribe specific policies.

How much is the December Child Tax Credit. For 2021 eligible parents or guardians. The total child tax credit for 2021 is up to 3600 per child age 5 and under and up to 3000 for each qualifying child age 6-17.

The monthly payments which began July 15 were limited to 2021 and the last one is set for Dec. Free 2-Day Shipping wAmazon Prime. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Discover The Answers You Need Here. That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. The credit amount was increased for 2021.

A childs age determines the amount. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46.

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Why A Cut To The Child Tax Credit In 2022 May Not Be The Last

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit Advanced Payments Information Bc T

Child Tax Credit Here S Who Will Get A Bigger December Payment The Us Sun

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Final Check Child Tax Credit Payment For December Youtube

What Families Need To Know About The Ctc In 2022 Clasp

Wtform Child Tax Credit Letter 6419 Explained Youtube

Last Day To Unenroll In July Advanced Child Tax Credit Payment